Business Insurance in and around Hartselle

One of Hartselle’s top choices for small business insurance.

Almost 100 years of helping small businesses

State Farm Understands Small Businesses.

Preparation is key for when an accident happens on your business's property like a customer stumbling and falling.

One of Hartselle’s top choices for small business insurance.

Almost 100 years of helping small businesses

Strictly Business With State Farm

Our business plans rarely account for every worst-case scenario. Since even your brightest plans can't predict global catastrophes or consumer demand. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance protects more than just your facility or shop.. It protects your hard work with coverage like business continuity plans and a surety or fidelity bond. Fantastic coverage like this is why Hartselle business owners choose State Farm insurance. State Farm agent Chad Hughey can help design a policy for the level of coverage you have in mind. If troubles find you, Chad Hughey can be there to help you file your claim and help your business life go right again.

Do what's right for your business, your employees, and your customers by getting in touch with State Farm agent Chad Hughey today to ask about your business insurance options!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

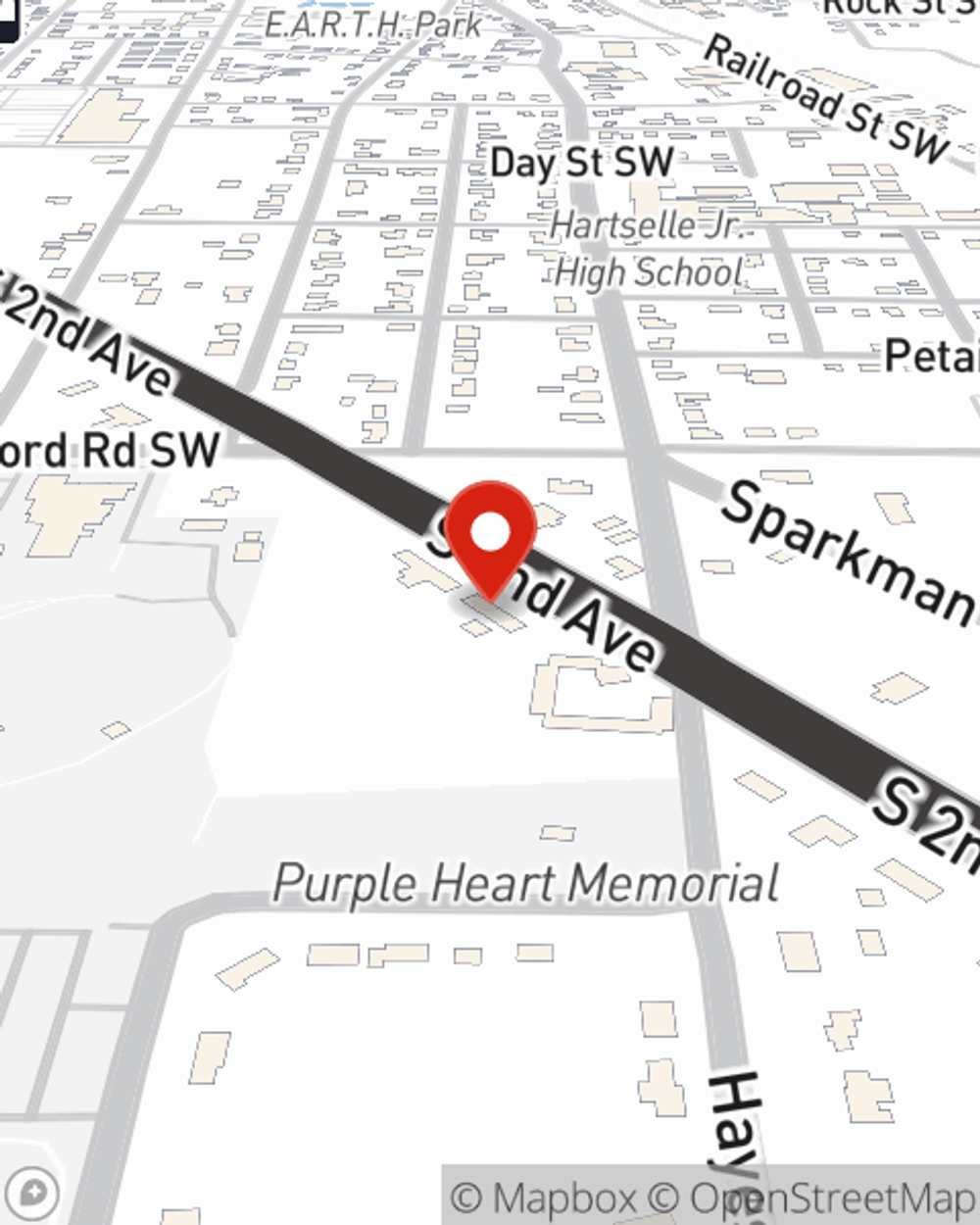

Chad Hughey

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.